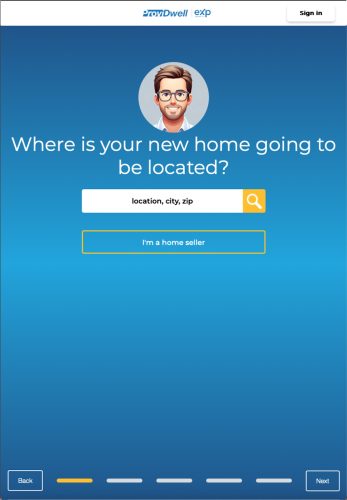

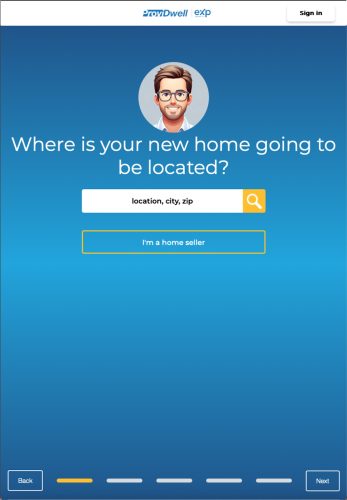

Step 1

Enter your desired location by County, Zipcode or City

We make it easy to find homes that have Assumable Mortgages.

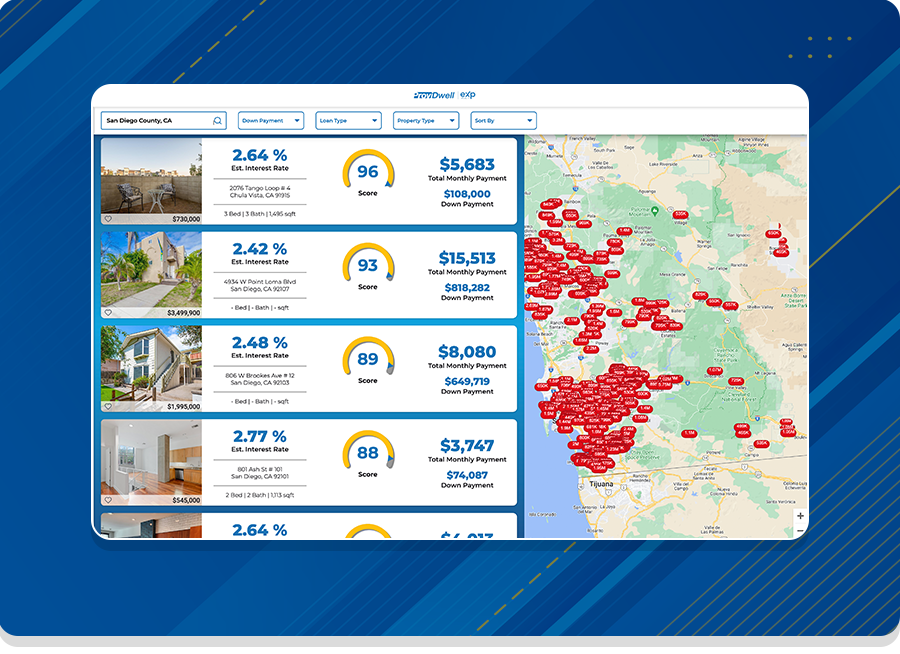

Discover homes with interest rates in the 2’s and customize your search by: Location, Down Payment, Loan or Property Type

Score is a combination of factors that make a property an excellent candidate for assumption to quickly find the best opportunities for you! These include interest rate, loan type, loan-to- value, days on MLS and unit mix.

Enter your desired location by County, Zipcode or City

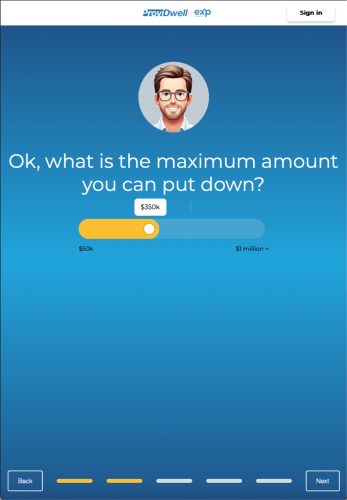

Dial up yoru maximum down payment. Set the bar high and expand visibility to key properties.

See real-time data based on your criteria. Actual active listings that includes:

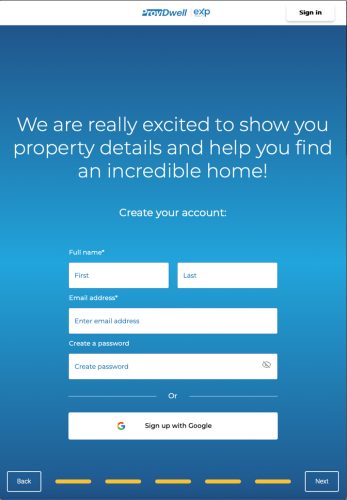

Create your account for free. We think you are going to love it!

Because assumptions are tricky, you have a few options to become a long term user.

BUYER

AGENT

An assumable mortgage is a type of home loan that allows a homebuyer to take over the existing mortgage terms from the seller, with no cost to the seller. Many government-backed loans, such as FHA and VA loans, are eligible for assumption, and millions of these mortgages are available.

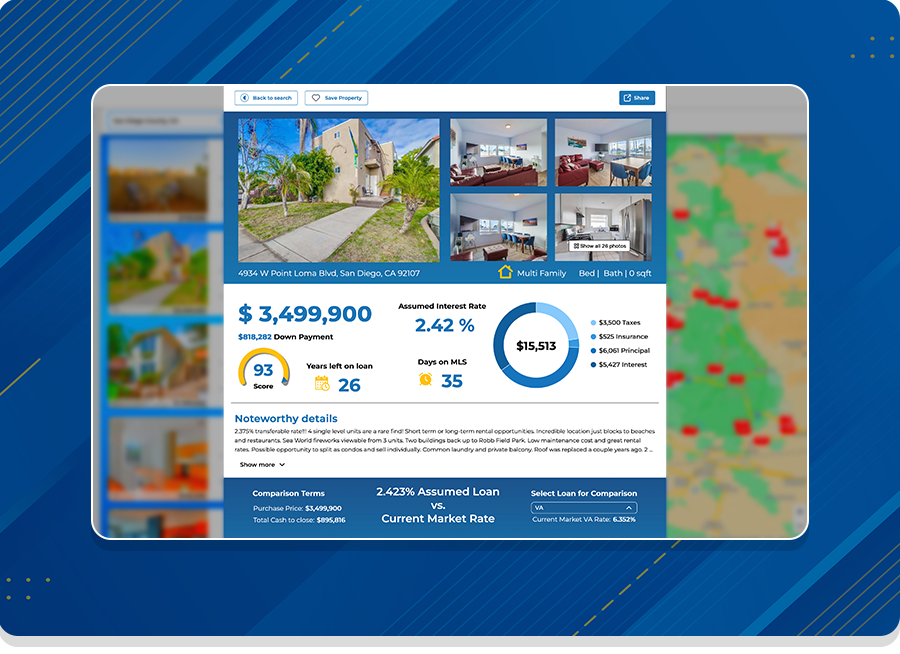

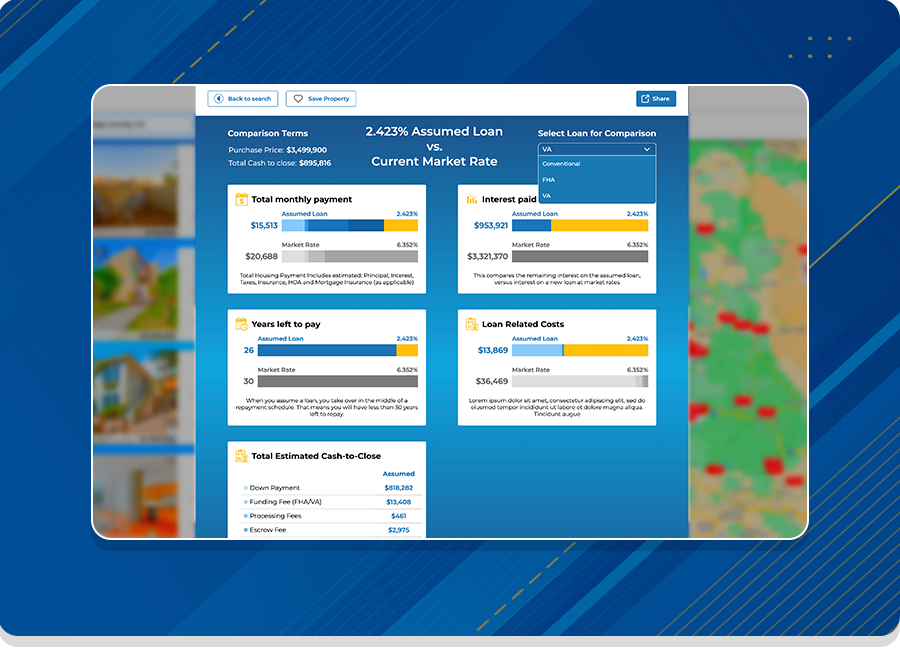

When interest rates on mortgages are high, assuming a mortgage with a rate as low as 2% allows buyers to save up to thousands monthly compared to buying a home with a traditional mortgage at today’s average rates of 7%. A low-rate assumable mortgage could be the key to finding your dream home at an affordable price.

If you meet the lender’s criteria, an assumable mortgage could be a great choice. Use the Providwell Score and breakdown the gap in loan amount and down payment in the mortgage comparison feature on the listing detail page.

Assuming a mortgage can seem complex and unfamiliar. Our advanced tool uncovers actively listed homes with assumable mortgages, focusing on sellers who are eager to make a move.

90% of homeowners don’t know their mortgage is assumable. Buyers who work with Providwell are 5x more likely to close in 45 days. Contact us at (858) 703-8142 to learn more.

While Providwell provides comprehensive support for the assumption process, it’s recommended that you work with a knowledgeable real estate agent with regional expertise. Providwell has developed an extensive network of agents who are well-versed in assumptions, and a Providwell advisor can connect you with a vetted agent if needed.

Providwell is your trusted partner for selling or buying a home with a low-rate assumable mortgage. We manage the assumption process from start to finish, enabling homebuyers to easily purchase their next home with a low-interest rate mortgage attached.

An assumable mortgage is a type of home loan that allows a homebuyer to take over the existing mortgage terms from the seller. All government-backed loans, such as FHA and VA loans, are eligible for assumption by law, and millions of these mortgages are available.

With today’s interest rates, including your low-rate assumable mortgage in your sale offers several benefits:

With interest rates at their highest in years, your low-rate mortgage is a valuable asset. Providwell helps sellers effectively market their assumable mortgage to maximize exposure and reach up to 5x more buyers.

We’ll work with your listing agent to market your listing to buyers interested in assuming a low-rate mortgage. We can also provide your agent with additional marketing resources to include with your listing.

For sellers who don’t have a listing agent, we can recommend a highly trusted and qualified agent who will partner with Providwell to sell your home along with your assumable rate mortgage.

Our software helps agents be successful with loan assumptions- and successful in general! Find your buyer a deal that is so good, they tell everybody!

A client acquisition tool – We make it easy for agents have more and better conversations with prospective buyer clients. Agents have the ability to give their buyers free access to our app – showing unique value and strengthening the relationship.

Data that gets offers accepted – We provide the financial analysis to show the value being unlocked through assumption. This gives buyers the data to submit an offer that gets accepted.

If you fill up your 20 free client seats, you can add another 20 for a nominal fee. Or use your limited seats to help get your BBE signed.

More Properties to see, less bad data. – don’t waste your time with properties that aren’t assumable, are already pending, or are a short sale. We carefully filter our data to help ensure you only see viable opportunities.